Digital Team Six in-house experts will work with your IT and Operations teams to get you access to broader coverage at reduced premiums.

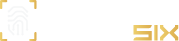

Need security training to improve your premiums?

Awareness training to industry, and regulatory standards and to meet Cybersecurity insurance requirements.

Comprehensive Prequalification Process.

Reduce digital risks and lower costs premium costs.

Prepare your business to reduce premiums and upfront costs for cyber insurance coverage by analyzing substandard security controls

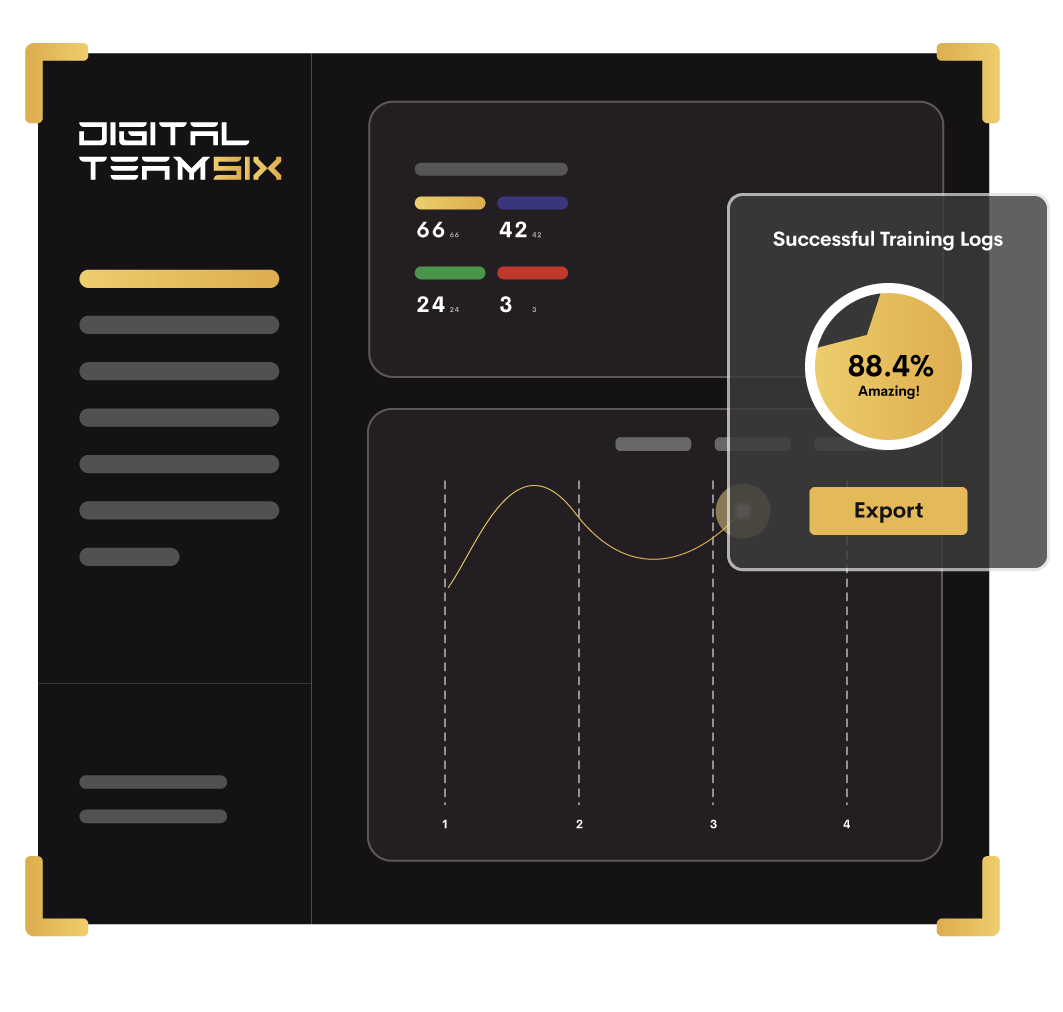

Defensible Capabilities

- Foundational security controls

- Adopt a comprehensive framework and standards

- Awareness training and digital “hygiene”

Optimal Responsiveness

- Build controls monitoring and reporting

- Enhance risk management and mitigation

- Function and role-based awareness and training

Adaptive Integration

- Align policies, standards and guidelines

- Enhance usability and accessibility

- Accelerate response and risk remediation

Compliant and Aligned

- Compliant to NIST and align to customer processes

- Program organization and management

- Periodic maturity dashboard and reporting

Security Controls

Transformation

Services can prevent data breaches while expanding digital transformation.

Go beyond the standard insurance policy. We're here to lower your digital risks by enabling incident readiness.

Risk Assessments and Management

Cyber Insurance is a cornerstone risk management practice for local government agencies, K12 when modernizing technology and digital transformation. The rise of cyber incidents against substandard security controls is leading to growing cyber insurance carriers raising premiums heavily or rejecting.

- Maximize your security perimeter and regulations

- Manage digital risks of your infrastructure and security posture

- Assert customer cybersecurity contractual requirements and obligations

Optimize Security and Coverage Policies

While the economics for ransomware operators have been growing more favorable, the economics of the cyber insurance industry is faltering. To stay solvent and viable, many cyber insurers are steeply increasing premiums, dropping coverage, or exiting the cyber insurance market altogether.

- Adaptive security assessments to improve your overall security

- Pre-vet your industry policies and procedures to increase your security and lower coverage

- Industry-specific compliance modules fortify your requirements for digital risk

Incident Response and Security Assessments

Our in-house team understands multiple states have taken steps to procure Cyber Insurance by collectively negotiating with insurance agencies similar to the prominent New Jersey Joint Insurance Fund (JIF) Municipal Excess Liability (MEL) and collectively agreeing to apply proactive Cybersecurity measures.

- Work closely with our expert digital risk assessment team to improve your coverage

- Integrated processes to navigate through requirements to reduce premium costs

- Reduce your digital risk through implementing consistent security controls

During your demo, we'll cover the following:

- Explore your existing security infrastructure

- Understand the level of digital risk you face

- Introduction to the threat monitoring systems

- Understand various compliance standards

- Address your questions about our solution